“The term prop firm” is becoming increasingly popular in the investment market and raises many questions about its operating model. This is seen as a promising form of investment for traders. However, before deciding to participate in the model, make sure to thoroughly understand the prop firm terminology and important truths in the following article. Definition of Prop Firm

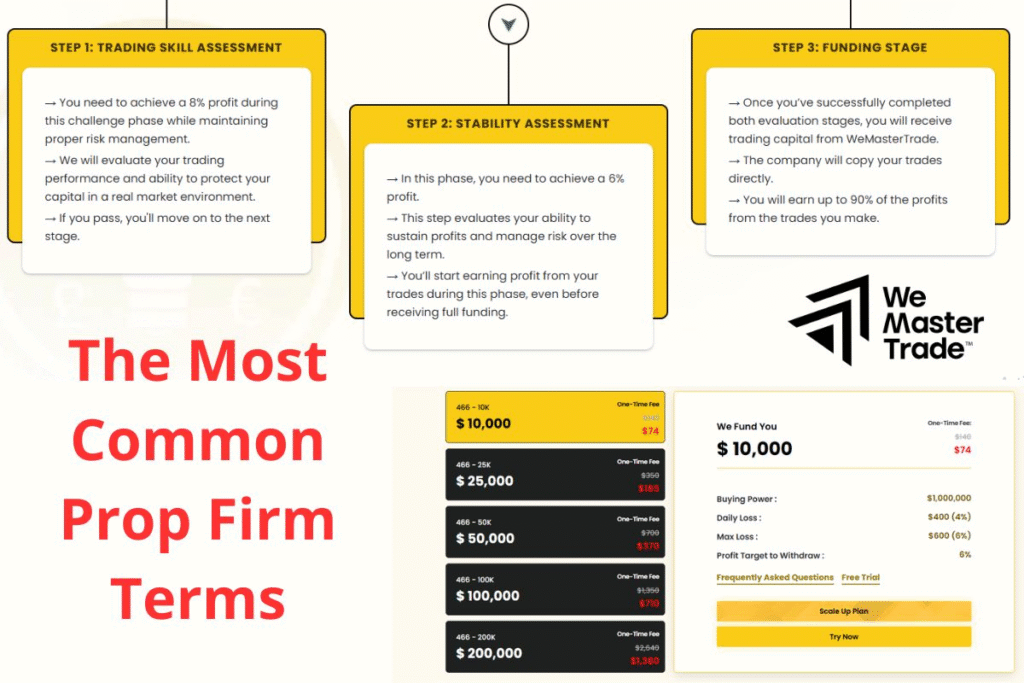

Service WeMasterTrade is a business under WeCopyTrade, which is a proprietary trading company based in Vancouver, Canada. Since its launch in 2022, the company has established its name. WeMasterTrade was founded to support ambitious traders but facing financial difficulties, as well as those with little experience, resources, and tools to establish a foothold in the market. Instead of taking over a year to save up $10,000 in cash to start trading, WeMasterTrade provides users with the opportunity to be funded and start trading immediately after paying a fee. This is a quick solution for those who want to start a trading career. WeMasterTrade offers a unique trading fund model, making it easy for investors to access capital and optimize profits. To receive funding from the fund, investors need to pass two challenge rounds with a practice account, allowing WeMasterTrade to assess their trading capabilities. Upon successful completion, traders will be provided with funds to trade with a profit-sharing ratio of up to 90%. Notably, for experienced traders, WeMasterTrade also offers direct funding services, allowing them to start trading immediately without going through the challenge rounds. This is the ideal opportunity for professional traders to access strong capital, maximize profit potential without being bound by lengthy evaluation processes. With a flexible strategy and superior financial support, WeMasterTrade not only helps traders alleviate capital pressure but also creates conditions for them to fully leverage their trading capabilities in the market.

Proprietary trading is a form where a financial institution uses its own capital to participate in trading in the financial markets to earn profits for the company itself, rather than trading on behalf of clients. Unlike the traditional brokerage model—where companies merely assist clients in buying and selling and charge fees—proprietary trading allows firms to actively buy and sell stocks, currencies (Forex), commodities, or derivatives for their direct benefit. This is the foundation of many modern prop firms.

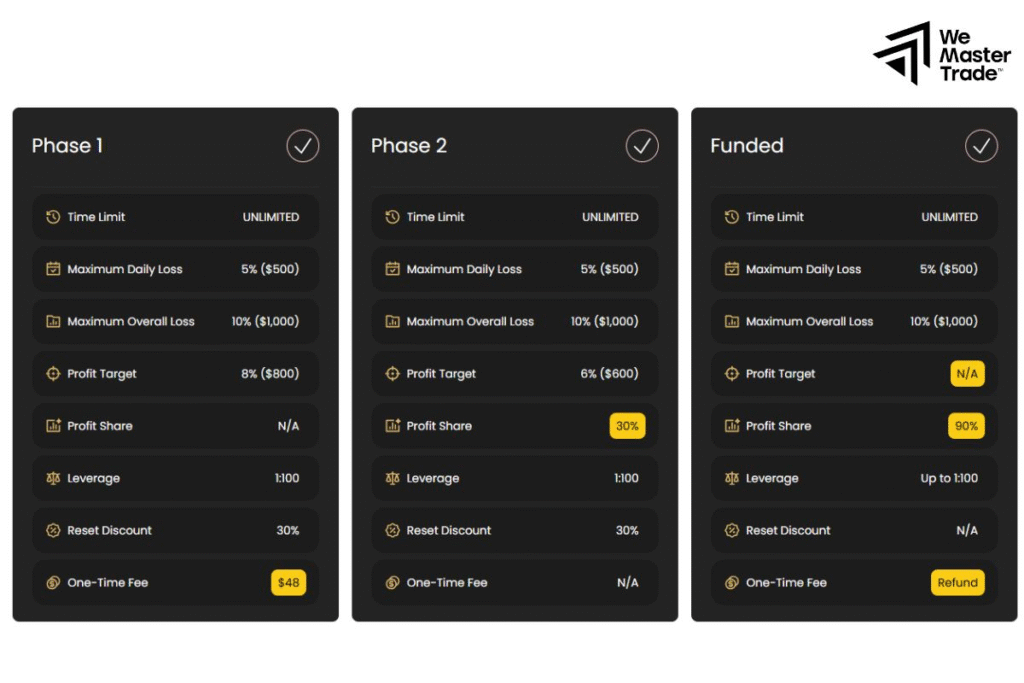

How Do Prop Firms Operate? A prop firm will invest capital in potential traders, allowing them to trade on a much larger scale than their personal accounts. This model provides mutual benefits: traders have the opportunity to earn more, while the firm receives a share of the profits from successful trades. The main factors in the operation of a prop firm include: Providing trading capital: Traders do not need to invest personal funds; the prop firm will provide capital after the trader passes an evaluation or challenge. Assessing capabilities: Companies often require traders to complete a simulated test or trial trade to demonstrate their skills and risk management abilities.

Risk control: There are strict rules such as limits on the number of loss orders, account drawdown levels, or requirements to place stop-loss orders to protect capital. Supporting technology: Prop firms use professional trading software, data analysis systems, and performance measurement tools to assist traders. Profit-sharing model: Traders earn money by sharing a percentage of the profits with the company, usually ranging from 50% to 90%, depending on performance and the program.

Benefits of Proprietary Trading Prop firms use their own capital to invest in the market with the goal of generating profit. Additionally, there are several other common reasons why the prop firm model is attracting increasing interest from individual traders. Maximizing Profits When prop firms or large financial institutions trade on their own, they are not limited by fees or commissions as in traditional brokerage services. Instead, they receive 100% of the profit from the investment if the trade is successful. This helps enhance overall profitability, especially in quarters or years with a bullish market.

REGISTER WEMASTERTRADE ACCOUNT: Enter discount code 20%: TRADEFOREX20

Accumulating Assets Ahead of Market Fluctuations

Proprietary trading at financial institutions often allows them to hold a significant volume of assets, such as stocks, bonds, or futures contracts. This brings several clear benefits for governance and customer support, including: Proactively providing liquidity: when the market experiences strong volatility or liquidity declines, having available assets in the portfolio helps the organization easily execute trades to meet client demand, or stabilize the market when necessary. Preparing for market risks: stockpiling assets is also a way for the organization to hedge against risks during unstable periods or deteriorating liquidity conditions, thereby reducing disruptions in trading activities. For traders, understanding this stockpiling mechanism of proprietary firms is also very important. It helps traders better anticipate capital flows, price dynamics, and supply-demand changes that may occur in the market, thus adjusting their trading strategies accordingly and minimizing unexpected risks. Market making and increasing influence Some prop firms can act as market makers—meaning they step in to buy or sell assets when the market lacks participants. Thanks to their ability to hold assets and ample capital, prop firms can help maintain liquidity for the market or specific securities. The Most Common Prop Firm Terms When participating in a trading model with a funded firm (prop firm), understanding prop firm terminology is a prerequisite for traders to operate their accounts effectively and comply with regulations. Below are commonly encountered terms: Funded Account: The account that a trader receives after passing evaluations. This account is traded with the capital of the prop firm, not personal funds. Challenge/Evaluation: The testing phase of the trader’s ability. You need to achieve specific profit goals within a specified timeframe, while not violating risk limits.

Profit Split: The profit after a successful trade will be shared according to a ratio between the trader and the prop firm, usually ranging from 70/30 to 90/10. Drawdown: This is the allowable loss limit, calculated daily or based on total account capital. Violating the drawdown often leads to loss of access to the account. Scaling Plan: Some prop firms have mechanisms to increase account size for traders who maintain stable trading performance over a long period. Daily Loss Limit: This is the daily loss limit. Exceeding this limit may result in account cancellation or suspension. EA (Expert Advisor): Automatic trading software. Not all prop firms allow the use of EA, so you should check the terms carefully before registering.

Mastering the prop firm terminology will help traders understand the operational mechanisms of the model, reduce risks, and optimize trading effectiveness.

Current Prop Firm Models Currently, the prop firm market offers various funding models to serve the diverse needs of traders. Among them, the three most popular models include: 2-Step Evaluation Model.

It is a standard challenge format consisting of two phases:

Phase 1: Achieve profit targets with specific drawdown and time limits.

Phase 2: A lower requirement but testing stability.

This is the most widely used model, suitable for traders who want to build reputation step by step.

1-Step Evaluation Model

Traders only need to pass a single challenge phase to receive funding. The profit requirement may be higher and the challenge duration shorter.

Suitable for experienced traders seeking quick access to capital.

Instant Funding Model

Traders can pay a fee to receive a real account immediately, without participating in a challenge. However, the initial profit withdrawal limit is often low and will gradually increase as the trader proves their performance.

Each prop firm model has its own advantages and disadvantages. Choosing the appropriate form should be based on trading ability, risk management skills, and personal financial goals.

Conclusion

In summary, simply put, a prop firm is a model where an organization trades with its own money to profit instead of serving as an intermediary for others, opening up opportunities for individual skilled traders who lack capital, helping them access the market more professionally. If you are interested in this field, being clear about prop firm terminology and operational mechanisms will be the first step to starting a serious and effective trading journey.

Disclaimer. WeMasterTrade or WeCopyTrade does not own or operate this website and is not responsible for its content. This website is owned by propfirm, an independent marketing partner. Propfirm also does not solicit or accept investment capital from anyone. All information shared is for reference only. Each individual is responsible for his/her own capital.

WeMasterTrade offers instant funding with very low fees, making it perfect for traders who want to start trading real capital quickly

The support team at WeMasterTrade is very responsive and helpful, always ready to assist with any issues

I appreciate the flexible risk management rules and the ability to trade Forex, Crypto, and Stocks all in one platform

Their payout process is fast and transparent, which builds a lot of trust for traders like me.

WeMasterTrade’s instant funding model saved me weeks of waiting compared to other prop firms

The profit split is fair and the trading conditions are suitable for both beginners and experienced traders