Knowing all the information about WeMasterTrade fund packages will help you choose a fund that suits your trading method. Additionally, understanding the trading principles will help you develop an appropriate trading strategy so that you do not violate the rules and have your funds recalled. Therefore, before you start participating in the WeMasterTrade trading fund, you should read this article thoroughly.

The trading principles of the WeMasterTrade fund

Currently, WeMasterTrade has issued quite a number of trading principles for investors. All the trading principles are listed below, among which the two principles Profit Consistency and Risk Consistency are the most challenging for investors, as most traders often violate these two principles. Let’s explore the detailed trading principles at WeMasterTrade.

REGISTER WEMASTERTRADE ACCOUNT: Enter discount code 20%: TRADEFOREX20

Criteria for eligibility to withdraw profits

Profit Target

This is the minimum profit level you can withdraw money, calculated as a percentage of the total initial capital of the fund. Most fund packages apply Profit Target, except for the package without Profit Target which is the 510Zero package.

Example: For a $10,000 fund, the 51010 package has a Profit Target of 10%. Therefore, when you trade and achieve a minimum profit of $1,000, you will meet the necessary condition to withdraw profits.

Profit Consistency

This is a criterion to assess a trader’s ability to generate consistent profits when trading in the market. Apart from the 51010-NoPC package, all other fund packages from WeMasterTrade apply this principle. This is considered sufficient condition for you to be able to withdraw profits (in addition to the necessary condition being Profit Target).

The formula for calculating Profit Consistency is as follows:

Profit Consistency (%) = Best trading day profit / Total profits of all trading days * 100

Example: You trade with a fund package that has a Profit Consistency rate of 20%. Daily profit/loss (calculated based on closed positions) across all trading days is as follows: Day 1: $100

Day 2: $200 –> Day with the highest profit

Day 3: -$50

Day 4: $100

Day 5: $60

The consistent profit rate is [200/(100+200-50+100+60)] * 100 = 48.7%. Where $200 is the profit from the best trading day and (100+200-50+100+60) is the total profit from all days. In this case, the trader does not meet the Consistent Profit requirement (<20%), so the trader will need to make more trades and have consistent profits to reduce the rate. Tips: To avoid violating the consistent profit when achieving the Profit Target, you should calculate to lock in daily profits not exceeding 20% of the Profit Target. For example, with a fund package of $10,000, if the Profit Target is 10% ($1,000), then each day you should stop locking in profits at a level of < $200 (20% * $1,000).

Profit Share is the actual profit you will receive when meeting the above withdrawal conditions (Profit Target and Profit Consistency). The maximum Profit Share will be 90%, depending on the number of profit withdrawals. Specifically:

Number of profit withdrawals Profit sharing rate

Round 1 50%

Round 2 75%

From round 3 onwards 90%

For some packages like 510Zero or 51010-NoPC, the Profit Share will be calculated differently depending on the accompanying conditions. Details of Profit Share for each package will be mentioned in the section introducing the WeMasterTrade fund packages below.

Principles of violation resulting in fund withdrawal

These are very important principles that you need to understand in order not to have your funds withdrawn. Especially with the quite strict principle of Risk Consistency.

Max Daily Loss

This is the maximum daily loss for your trading account. It is calculated as a percentage of the total initial capital of the fund, including both closed and open orders.

Example: With an initial capital of 10,000$ for the 51010 fund package, the Max Daily Loss will be 5%, meaning your daily loss must not exceed 500$.

Max Total Loss

This is the maximum total loss for all the trades you have made. It is also calculated as a percentage of the total initial capital of the fund, including both closed and open orders.

Example: With an initial capital of 10,000$ for the 51010 fund package, the Max Total Loss will be 10%, meaning your maximum loss must not exceed 1000$.

Risk Consistency

This can be considered the toughest principle and traders often easily violate it when trading with the WeMasterTrade fund packages. The rule requires that the maximum loss (including open orders) on each Trade Idea must be kept consistent and not exceed 2% of the initial capital of the account.

Trade Idea: is a series of trades in the same direction on the same asset pair.

Example: You are trading with the 51010 package, with an initial capital of 10,000$. Thus, Risk Consistency will be 2% * 10,000$ = 200$. If you open 3 buy (BUY) orders for gold (GOLD) regardless of when the orders are opened, the following cases will be considered violations: Total floating loss of these 3 orders (not closed) > 200$.

If all 3 orders are closed at the same time, or within 3 minutes, and the total loss of the 3 orders > 200$.

However, if you open 1 BUY order for gold and then open another BUY order for EUR/USD, the 2% Risk Consistency will be applied separately for each order.

Tips: to avoid violating RC, you should calculate the total trading volume on your orders within safe conditions (limit trading with large volumes).

Note: The 51010-NoPC package will have a Risk Consistency of 1%. Swap fees, commission fees, and other types of fees are also included in the total risk.

Other violation policies

IP Duplication: Trading, logging in, or logging out from an IP address that matches any customer in the system.

Copying trades from others: Your trade orders are duplicates of any orders from other customers trading at WeMasterTrade.

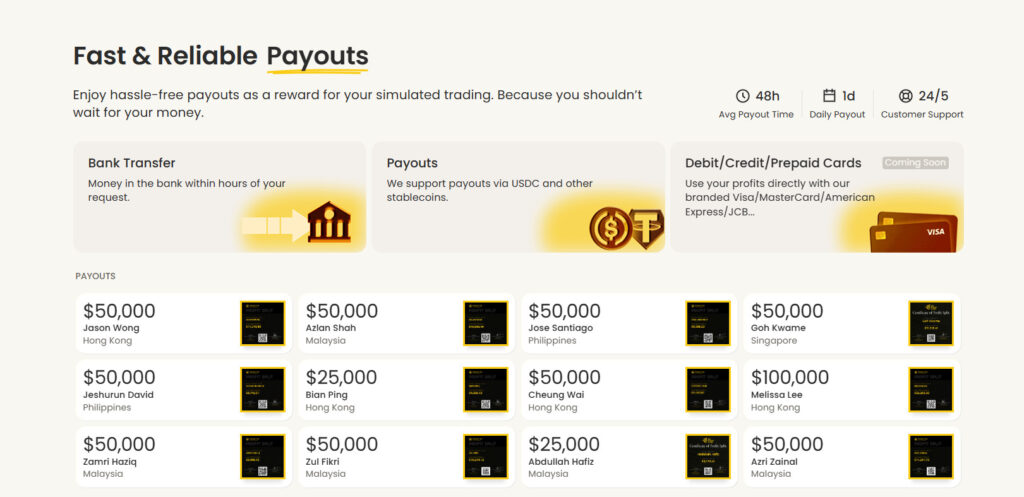

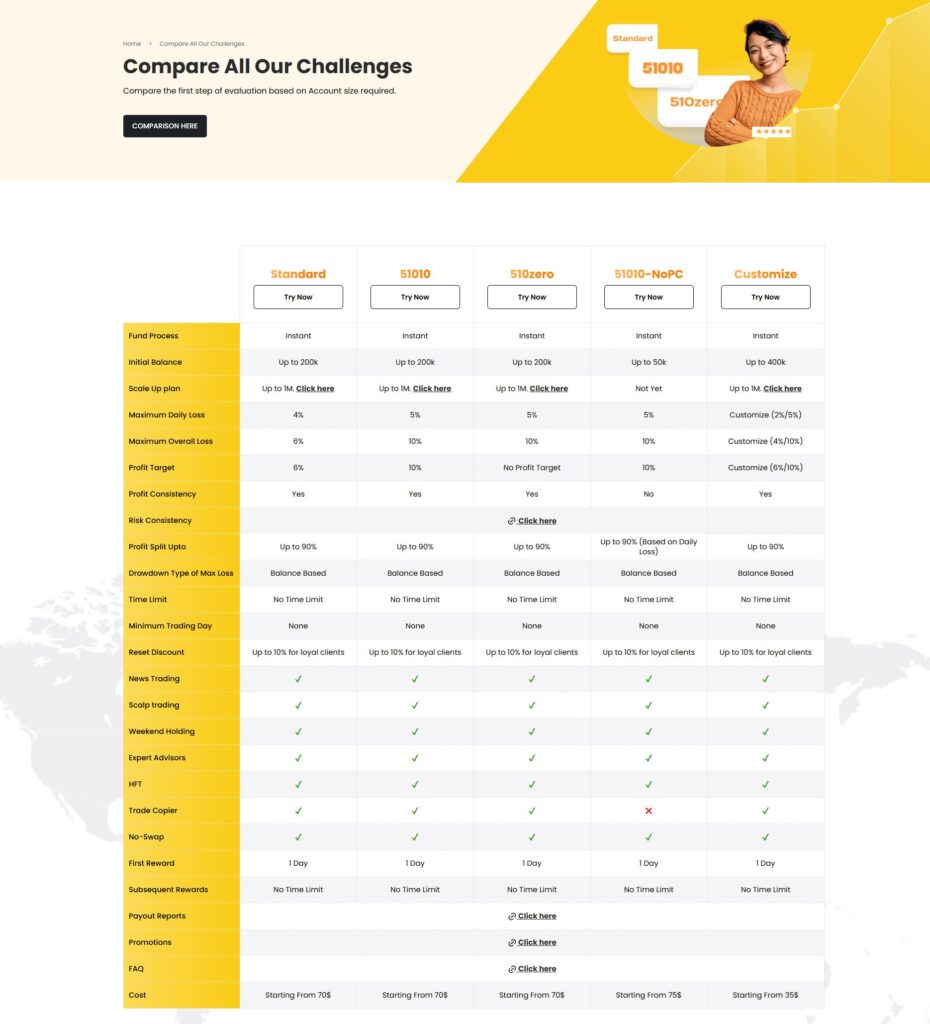

Detailed information about WeMasterTrade fund packages WeMasterTrade offers many fund package options suitable for different trading strategies. The fund packages can be divided into 2 groups: Instant package group and Challenge package group. Specifically, let’s explore the details of WeMasterTrade’s fund packages below. Instant package To easily visualize and compare the Instant packages, we can observe the comparison table in the image below. In this article, I will describe in detail the key differences to note for some of the packages.

The above contains all the important and necessary information that you need to be clear about before participating in trading with the WeMasterTrade fund. For any questions, please join the community below for assistance:

Disclaimer. WeMasterTrade or WeCopyTrade does not own or operate this website and is not responsible for its content. This website is owned by propfirm, an independent marketing partner. Propfirm also does not solicit or accept investment capital from anyone. All information shared is for reference only. Each individual is responsible for his/her own capital.