Top Prop firms have increasingly proven their strong position in the market with attractive privileges and unlimited opportunities to explore the market. However, not all prop firms are trustworthy. How to find a reliable prop firm? Let’s discover the secrets in the following article:

What is a Prop Firm?

A prop firm (proprietary trading company) is a place that provides capital to qualified traders in return for a share of the profits from their trades. This model opens up opportunities for those who have skills but lack capital, making it especially suitable for individual traders looking to start a professional career. However, the rapid development of this model has also led to many difficult-to-distinguish options. Finding a reliable prop firm is a key factor for traders to avoid risks or wasting time with low-quality platforms.

How to Choose the Right Trustworthy Prop Firm Address The prop firm market is rapidly growing, offering many attractive options for traders. However, not every prop firm is reliable. So how do you choose the right trustworthy prop firm – a place that not only provides capital but also accompanies you on your professional trading journey? Below are important criteria that professional traders often carefully consider before ‘entrusting their accounts’: Transparency and Reputation Prioritize prop firms with positive feedback from the trading community, clear policies, and no ambiguity. There should be publicly available information about trading conditions, profit-sharing rates, challenge processes, and payments. Reasonable Profit-Sharing Rates The minimum should be at least 80% or higher. More importantly, there should be easy, timely withdrawals without hidden fees.

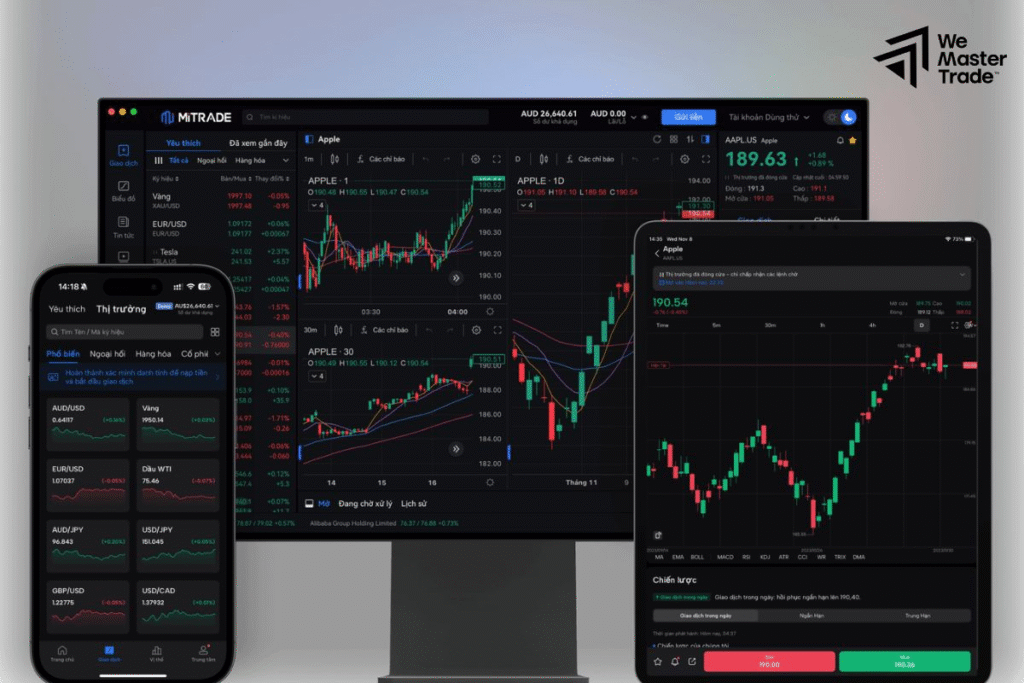

Top Prop Firm. Stable Trading Platform

Support for popular platforms such as MT4/MT5, or custom low-latency, easy-to-use, and reliable platforms.

Clear risk management.

There are visual drawdown tracking tools.

Applying transparent risk limits to help traders have better control.

Comprehensive support and training.

Reputable prop firms often invest in training systems, providing materials and support from A to Z, even for newcomers.

Community and companionship.

Not just a funding provider, but also creating a long-term supportive ecosystem for traders, helping them develop sustainably in the profession.

Top 5 Trusted Prop Firms for Freelance Traders.

Explore reliable prop firms highly rated by the international trader community. Below is a list of the top 5 prop firms along with practical perspectives from traders to help you make the right choice.

One prominent prop firm currently in the trader community is WeMasterTrade. This platform offers: Profit sharing of up to 90%, transparent evaluation suitable for new traders, flexible support programs like Freeswap and BOGO, a training ecosystem, community, and in-depth performance reports, fast support times, and clear commitments. Thanks to these practical advantages, WeMasterTrade is gradually affirming its position as a reliable prop firm in Vietnam, especially for those who want to develop sustainably and long-term. Topstep is a trusted prop firm chosen by many traders in the US. Traders can keep 100% of the first profits (up to $10,000) and 90% thereafter. The entry test is simple, time-unlimited, as long as you adhere to risk management principles. FTMO is an established and reputable prop firm, with a clear two-stage evaluation process. Funded accounts up to $200,000, profit sharing of 80%–90% along with comprehensive analysis and training support tools. Traders can also trial for free before deciding to join. The Funded Trader stands out with diverse challenge models, a vibrant Discord community, and profit sharing of up to 90/10. This is an attractive option for those seeking flexibility and connections with a global community.

Funded Next impresses by sharing 15% of profits right in the challenge phase – a notable difference. There is no time limit for assessment, and risks are based on account balance, helping traders manage their capital more safely. Be Cautious With Prop Firm Models That Lack Transparency During the search for a reliable prop firm, traders must be particularly wary of models that lack transparency – which carry many financial risks and threats to personal reputation. Below are some common signs of unreliable prop firms: Excessive Advertising Some prop firms often use sensational messages like “easy pass – super-fast withdrawals” to attract users. However, if they are not accompanied by clear evidence such as real reviews from traders, transparent reports, or feedback from the professional community, you should think carefully. A reliable prop firm never needs to boast excessively; they let user experiences speak for themselves. Hidden Fees Many new traders find themselves participating in prop firms with hidden fees such as: Unusually high withdrawal fees Unannounced account maintenance fees Penalties for technical errors or vague violations These costs are often not disclosed upfront and only become apparent when you have lost money or cannot continue trading. Conversely, a reliable prop firm always clearly discloses all costs in their policy before traders make decisions. Ambiguous profit sharing and payment policies A typical sign of a non-transparent model is a lack of clarity in profit sharing: No commitment to specific payment timelines Surprising low-profit sharing ratios without notice Providing vague reasons to delay or withhold trader funds A reliable prop firm will have a clear profit withdrawal process, fixed payment schedules, and will not change terms arbitrarily.

Lack of legal information

If a prop firm does not disclose its company address, operating license, the name of the managing organization, or does not have authentic reviews from traders who have experienced it, that is a serious warning. A platform that lacks a clear operational footprint should also not be a place where you invest your time, skills, and money. Before choosing to collaborate with any platform, thoroughly investigate through independent review channels, experienced trader communities, and compare with reliable prop firm addresses that are operating transparently in the market. Conclusion In summary, choosing the right trustworthy prop firm will help you save time, avoid risks, and have the opportunity to enhance your trading skills in a professional environment. Take the time to study, carefully compare important factors, and heed the experiences of former traders. A wise choice today can lay the foundation for a sustainable trading career tomorrow.

Disclaimer. WeMasterTrade or WeCopyTrade does not own or operate this website and is not responsible for its content. This website is owned by propfirm, an independent marketing partner. Propfirm also does not solicit or accept investment capital from anyone. All information shared is for reference only. Each individual is responsible for his/her own capital.